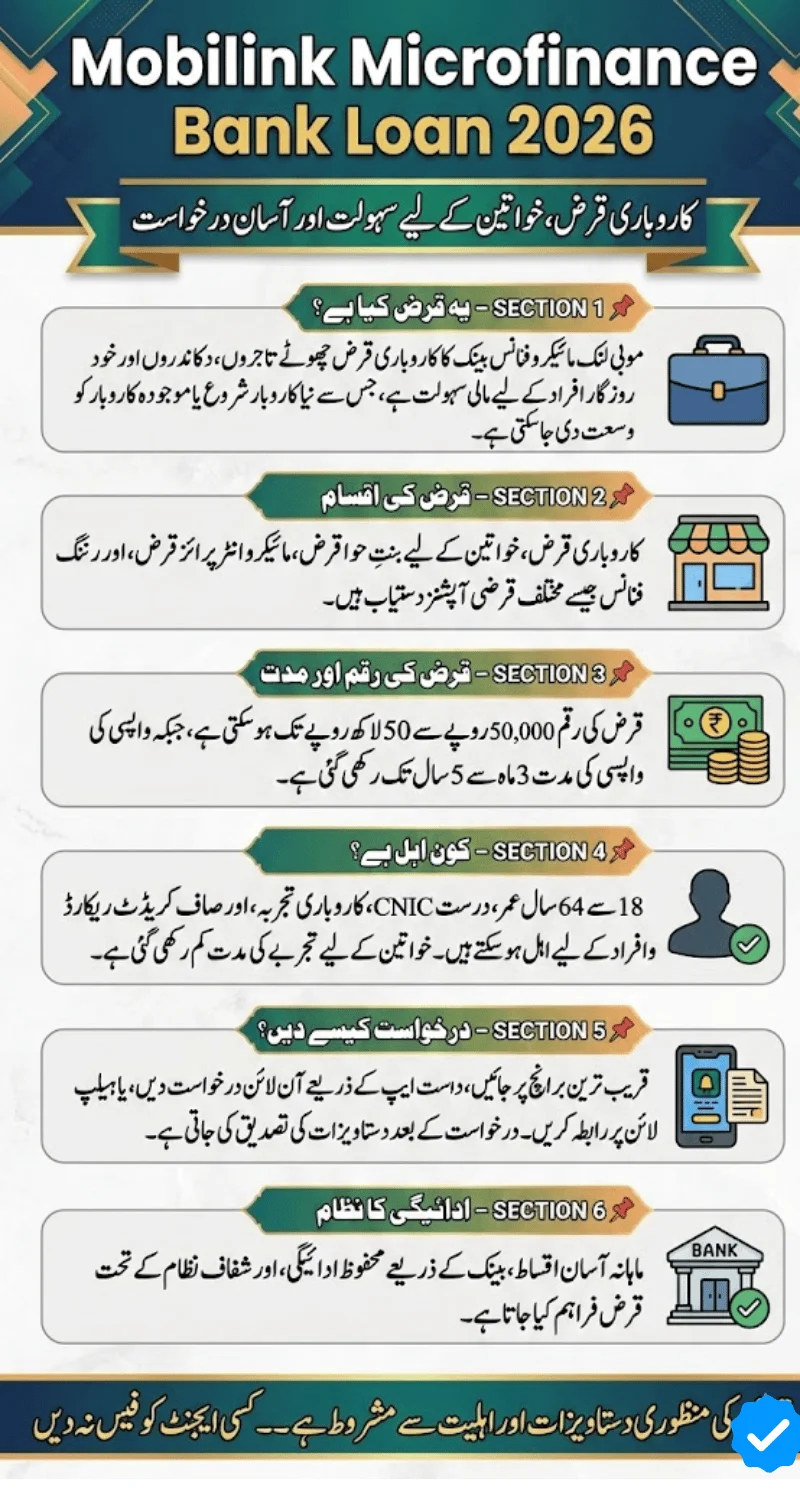

Starting or expanding a small business in Pakistan often becomes difficult due to limited access to bank financing. To bridge this gap, Mobilink Microfinance Bank offers a range of business loan options for 2026, designed specifically for small traders, shop owners, self-employed individuals, and women entrepreneurs.

These loans focus on easy access, flexible repayment, and digital convenience, making them suitable for people who cannot qualify for traditional commercial bank loans.

Mobilink Microfinance Bank Business Loan 2026 – Quick Overview

| Feature | Details |

|---|---|

| Bank Name | Mobilink Microfinance Bank |

| Loan Purpose | Business setup or expansion |

| Minimum Loan | Rs. 50,000 |

| Maximum Loan | Rs. 5,000,000 |

| Loan Tenure | 3 months to 5 years |

| Women-Focused Loan | Bint-e-Hawwa Loan |

| Collateral | Optional (required for higher limits) |

| Application Methods | Branch & Dost App |

Who Are These Business Loans For?

Mobilink Microfinance Bank business loans are ideal for:

-

Small shopkeepers

-

Retail and wholesale traders

-

Service providers

-

Home-based business owners

-

Women entrepreneurs

-

Micro and small enterprises

These loans are designed for self-employment and income generation, especially where commercial bank financing is not accessible.

Karobar Loan – Best for Small Business Expansion

The Karobar Loan is one of the most popular financing options for micro-business owners.

Key features:

-

Loan amount: Rs. 50,000 to Rs. 500,000

-

Tenure: 3 to 24 months

-

Easy monthly installments

-

Fast processing at MMBL branches

Suitable for:

-

Grocery stores

-

Small retail shops

-

Repair services

-

Street-level businesses

This loan helps manage stock purchases, rent, and daily operating expenses.

Bint-e-Hawwa Loan – Business Support for Women

The Bint-e-Hawwa Loan is specially designed to empower women entrepreneurs.

Main benefits:

-

Loan limit up to Rs. 500,000

-

Available for new or existing businesses

-

Minimum 1 year business experience accepted

-

Smartphone and digital support options

Ideal for:

-

Boutiques

-

Beauty salons

-

Tailoring units

-

Home-based businesses

This loan encourages financial independence and digital business management for women.

Microenterprise Loan & Running Finance Options

For businesses needing higher financing, MMBL offers secured loan products.

Microenterprise Loan

-

Loan amount: Rs. 50,000 to Rs. 5 million

-

Requires collateral (gold or property)

-

Suitable for growing businesses

Running Finance

-

Revolving credit facility

-

Loan limit up to Rs. 5 million

-

Tenure up to 5 years

-

Ideal for working capital and daily cash flow

These options support businesses with larger operational needs.

Eligibility Criteria for Business Loans

Applicants must meet the following conditions:

-

Age between 18 and 64 years

-

Minimum 2 years of business experience

-

Women-focused loans accept 1 year experience

-

Annual household income below Rs. 1,500,000

-

Applicant must not be a loan defaulter

Required Documents

Prepare the following documents before applying:

| Document | Purpose |

|---|---|

| CNIC / Smart CNIC | Identity verification |

| Passport-size photos | Record keeping |

| Business address proof | Location verification |

| Rent agreement / ownership proof | Business premises |

| Utility bill history | Payment credibility |

Correct documentation speeds up approval.

How to Apply for Mobilink Microfinance Bank Business Loan

You can apply through multiple channels:

-

Visit the nearest Mobilink Microfinance Bank branch

-

Speak directly with a loan officer

-

Apply digitally via the Dost App

-

Call the helpline: 051-111-962-962

Official website: mobilinkbank.com

Why Choose Mobilink Microfinance Bank?

-

Designed for small and micro businesses

-

Flexible repayment plans

-

Women-focused financial inclusion

-

Digital access and branch support

-

Nationwide presence

MMBL focuses on financial inclusion and entrepreneurship growth across Pakistan.

Frequently Asked Questions (FAQs)

🔹 What is the minimum loan amount from Mobilink Microfinance Bank?

The minimum business loan starts from Rs. 50,000.

🔹 What is the maximum loan limit?

Eligible businesses can receive up to Rs. 5 million, depending on loan type and collateral.

🔹 Is collateral required for all loans?

No. Small loans may be collateral-free. Higher loan amounts require gold or property as security.

🔹 Can women apply for business loans?

Yes. The Bint-e-Hawwa Loan is specially designed for women entrepreneurs.

🔹 How long does loan approval take?

Approval time varies, but small loans are usually processed quickly once documents are complete.

🔹 Can I apply online?

Yes. Applications can be started through branches or the Dost App.

Final Summary

-

Mobilink Microfinance Bank offers business loans from Rs. 50,000 to Rs. 5 million

-

Special loan options for small businesses and women entrepreneurs

-

Flexible repayment from 3 months to 5 years

-

Easy application through branches and digital platforms

Mobilink Microfinance Bank business loans in 2026 provide a practical, accessible, and growth-focused financing solution for Pakistan’s small business community.

This content is published for general information and awareness purposes. kixxoil.pk is an independent informational website and is not officially connected with any government authority or public institution. Readers are encouraged to confirm details directly from official sources before making any decisions.