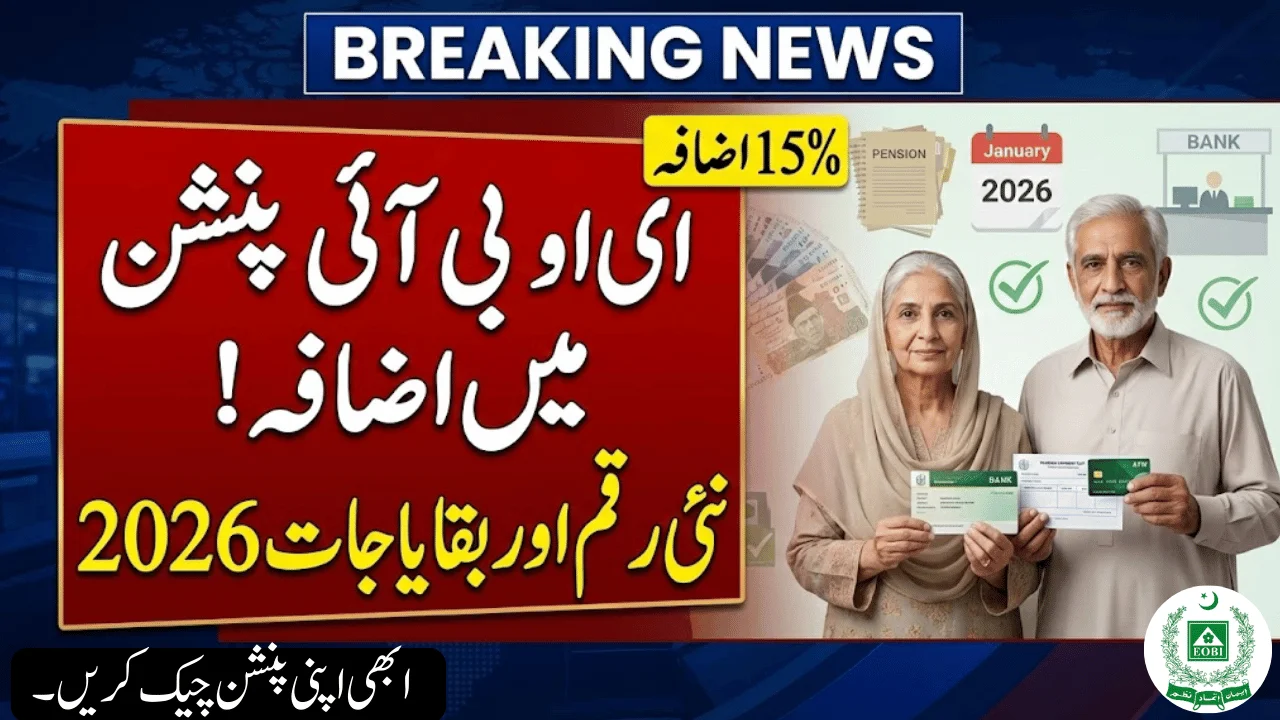

A major relief announcement has arrived for retired workers across Pakistan. The federal government has approved a 15% increase in pensions under the Employees Old-Age Benefits Institution (EOBI), bringing higher monthly payments and long-awaited arrears for eligible pensioners starting in 2026.

This decision is aimed at easing the financial pressure on retirees struggling with rising living costs and inflation.

Why the Government Approved the EOBI Pension Increase

The pension revision was finalized after reviewing the sharp increase in essential expenses such as food, utilities, and healthcare. Instead of placing pressure on the national budget, the increase will be funded entirely from EOBI’s own income and investments, making the move financially sustainable.

The core goal is simple:

protect pensioners’ purchasing power and provide stability in retirement income.

What’s New in the EOBI Pension Increase 2026

Here’s what pensioners need to know:

-

Minimum monthly pension raised to Rs 11,500

-

15% increase for all pensions above Rs 10,000

-

Increase effective from 1 January 2026

-

Arrears payable from the effective date

-

Around 500,000 pensioners expected to benefit

Updated EOBI Pension Rates at a Glance

| Previous Pension | New Monthly Pension (2026) |

|---|---|

| Rs 10,000 or less | Rs 11,500 |

| Above Rs 10,000 | 15% increase |

Payment Schedule & Arrears Details

-

Effective Date: 1 January 2026

-

Arrears: Paid for all months since the effective date

-

Payment Method: Bank transfer or existing payment channels

-

Frequency: Regular monthly pension schedule

Pensioners do not need to submit a new application if their records are complete and verified.

Who Is Eligible for the EOBI Pension Increase?

You will receive the increased pension if:

-

You were a registered EOBI pensioner as of 1 January 2026

-

Your documentation is complete and verified

-

Your case is not under legal dispute

Who May Face Delays or Ineligibility

-

Individuals not registered with EOBI

-

Pensioners with incomplete verification

-

Accounts involved in legal or compliance issues

How EOBI Can Afford the Increase

EOBI’s recent financial reports show:

-

Nearly 40% growth in institutional income

-

Strong returns from investments and employer contributions

-

No need for additional government funding

This ensures the pension increase is stable, responsible, and repeatable.

Economic Impact of the Pension Increase

The pension hike is expected to:

-

Improve household financial security

-

Increase local market spending

-

Strengthen trust in Pakistan’s social protection system

-

Support broader economic circulation

Pension income typically flows directly back into the economy, especially for essentials.

Challenges to Watch

While the increase is welcome, a few challenges remain:

-

Data verification for older records

-

Bank processing delays in some regions

-

Long-term sustainability if income growth slows

Authorities say monitoring systems are being improved to reduce delays.

What’s Next for EOBI Pensioners?

Looking ahead, EOBI plans to:

-

Expand coverage to informal sector workers

-

Digitize pension verification systems

-

Improve payment transparency and access

These steps could bring millions more workers into the social security net.

Final Verdict

The EOBI Pension Increase 2026 is a meaningful step toward protecting retirees from inflation and financial uncertainty. With higher monthly payments, arrears from January, and no added burden on taxpayers, this move strengthens confidence in Pakistan’s pension system.

If you’re an EOBI pensioner, ensure your records are updated so you don’t miss out on the revised payments.

source: DAWN

This content is published for general information and awareness purposes. kixxoil.pk is an independent informational website and is not officially connected with any government authority or public institution. Readers are encouraged to confirm details directly from official sources before making any decisions.