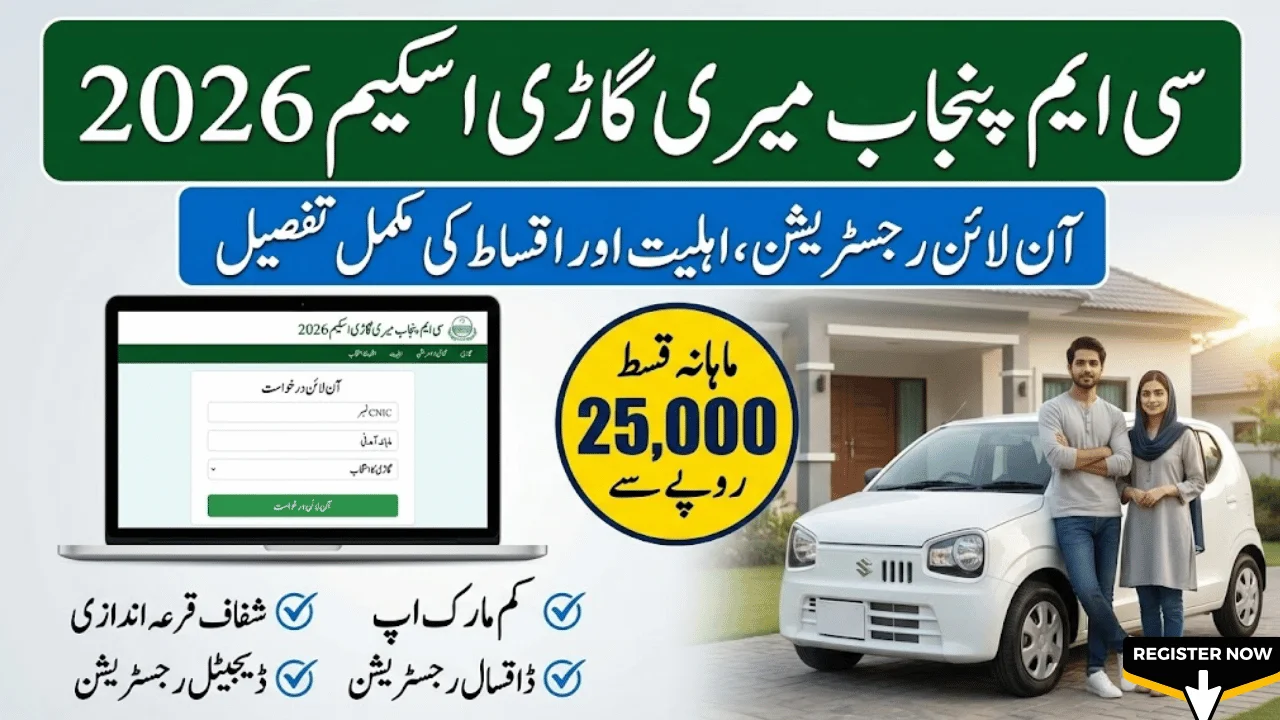

The CM Punjab Meri Gari Scheme 2026 is a landmark vehicle financing initiative launched by the Government of Punjab under the leadership of Maryam Nawaz.

This program aims to make car ownership possible for low- and middle-income citizens through transparent digital registration and highly subsidized bank financing.

With rising fuel costs and limited public transport options, the scheme provides a practical solution for students, working women, salaried professionals, and individuals seeking income through ride-hailing or local transport services.

CM Punjab Meri Gari Scheme 2026 – Key Highlights

| Feature | Details |

|---|---|

| Monthly Installment | Starting from Rs. 25,000 |

| Down Payment | 15% to 20% |

| Markup Rate | Subsidized (Approx. 6%–8%) |

| Repayment Period | 3 to 7 years |

| Vehicle Options | New & certified used cars (up to 3 years old) |

| Application Method | Fully online |

| Eligibility Area | Punjab domicile holders |

This scheme removes intermediaries and ensures direct coordination between applicants and partner banks through a secure balloting system.

Who Can Apply for CM Punjab Meri Gari Scheme?

To maintain fairness and financial sustainability, the Punjab government has introduced clear eligibility criteria:

-

Age Requirement: 20 to 50 years at the time of application

-

Monthly Income: Minimum Rs. 30,000 (verifiable)

-

Residency: Valid Punjab domicile with CNIC

-

Credit Record: No previous bank loan defaults

-

Priority Quota:

-

Female students

-

Working women

-

Differently-abled citizens

-

Applicants meeting these requirements have a strong chance of approval during the digital draw.

How to Apply Online for CM Punjab Meri Gari Scheme 2026

The registration process is designed to be simple and paperless:

-

Visit the official Punjab vehicle financing portal (linked via the Punjab government website).

-

Create an account using your CNIC and registered mobile number.

-

Choose your preferred vehicle category.

-

Enter employment and income details accurately.

-

Upload required documents in clear scanned format.

-

Submit the application and note your tracking ID for future reference.

Incomplete or incorrect information may lead to rejection, so accuracy is essential.

Required Documents for Registration

Prepare the following documents before applying:

-

CNIC: Front and back scanned copies

-

Income Proof:

-

Salary slips (employees)

-

6-month bank statement (self-employed)

-

-

Utility Bill: Electricity or gas bill (last 3 months)

-

Photographs: Recent passport-size photos

-

Driving License: Preferred but not mandatory

Providing clear and readable documents increases approval speed.

Installment Plan & Financial Benefits

Under this scheme, vehicle financing becomes significantly cheaper compared to private banks.

For example:

-

Car Price: Rs. 1,600,000

-

Down Payment: 15%

-

Monthly Installment: Approx. Rs. 25,000

-

Tenure: Up to 7 years

The government subsidizes the markup, making this plan suitable not only for personal use but also for income generation through platforms like Careem, Bykea, or local transport services.

How to Check Application Status

Applicants can track progress through multiple official channels:

-

Online Portal: Log in using CNIC credentials

-

SMS Alerts: Automatic updates sent to registered numbers

-

e-Khidmat Centers: Physical assistance for verification and queries

Statuses typically include “Under Review,” “Verified,” or “Approved.”

Why CM Punjab Meri Gari Scheme 2026 Matters

This initiative goes beyond car ownership. It supports:

-

Employment generation

-

Women’s mobility and independence

-

Youth economic participation

-

Transparent, corruption-free financing

By combining digital governance with subsidized loans, the Punjab government has introduced one of Pakistan’s most accessible vehicle financing programs.

Final Thoughts

The CM Punjab Meri Gari Scheme 2026 is a powerful opportunity for eligible residents of Punjab to secure reliable transportation without financial strain. With low markup rates, flexible installments, and a fully online process, the scheme sets a new standard for public welfare programs in Pakistan.

If you meet the eligibility criteria, ensure your documents are complete and apply early to maximize your chances in the balloting process. This initiative could be the first step toward financial stability, independence, and long-term mobility.

This content is published for general information and awareness purposes. kixxoil.pk is an independent informational website and is not officially connected with any government authority or public institution. Readers are encouraged to confirm details directly from official sources before making any decisions.