The CM Punjab Loan Scheme 2026 is one of the most important financial support programs launched for the people of Punjab who want to start or expand their own businesses. This scheme is specially designed for small business owners, self-employed individuals, skilled workers, and young entrepreneurs who face financial difficulties but have the passion to work and grow.

This article is published by PVS.com.pk to provide clear, original, and easy-to-understand information for users searching online for CM Punjab Loan Scheme 2026, loan registration, eligibility, and application process.

Introduction to CM Punjab Loan Scheme 2026

Starting a business or becoming self-employed is a dream for many people in Punjab, especially in rural and semi-urban areas. Unfortunately, lack of capital and high-interest private loans become major obstacles. To solve this issue, the Government of Punjab introduced the CM Punjab Loan Scheme 2026.

This program offers easy, low-interest loans to eligible citizens so they can earn a stable income, support their families, and contribute to economic growth. The application process is simple, transparent, and completely online.

What is the CM Punjab Loan Scheme?

The CM Punjab Loan Scheme is a government-backed financial assistance program that provides affordable loans for:

-

Small business startups

-

Expansion of existing businesses

-

Self-employment projects

-

Skilled labor and service-based work

Unlike private lenders, this scheme focuses on low interest rates, flexible repayment, and easy access, ensuring that deserving individuals are not burdened with financial stress.

Key Details of CM Punjab Loan Scheme 2026

| Feature | Details |

|---|---|

| Program Name | CM Punjab Loan Scheme |

| Year | 2026 |

| Loan Amount | PKR 50,000 to PKR 1,000,000 |

| Interest Rate | Low & government-subsidized |

| Repayment Period | 12 to 36 months |

| Application Method | Online via official portal |

| Target Groups | Small businesses, self-employed, youth |

This structure makes the scheme suitable for people with limited banking knowledge.

Objectives of CM Punjab Loan Scheme 2026

The scheme has been launched with clear and practical goals:

-

Promote self-employment in Punjab

-

Support small and micro-businesses

-

Reduce unemployment and poverty

-

Encourage youth entrepreneurship

-

Strengthen rural and semi-urban economies

By empowering individuals, the government aims to build a self-reliant and productive society.

Loan Amount & Financial Support

Under the CM Punjab Loan Scheme 2026, applicants can receive loans ranging from PKR 50,000 to PKR 1,000,000. The amount depends on:

-

Nature of business

-

Estimated startup or expansion cost

-

Applicant’s repayment capacity

The funds can be used for equipment purchase, shop setup, tools, raw materials, or service-based work.

Eligibility Criteria for CM Punjab Loan Scheme

The eligibility conditions are kept simple so that maximum people can benefit:

-

Applicant must be a resident of Punjab

-

Age must be 18 years or above

-

Must be self-employed, a small business owner, or planning a business

-

Should not be a defaulter of previous government loans

-

Must possess a valid CNIC

-

Basic business idea or plan (where applicable)

This inclusive approach supports villagers, shopkeepers, technicians, farmers, and skilled workers.

Required Documents

Applicants need to prepare the following documents:

-

CNIC copy

-

Proof of residence

-

Basic business details or plan

-

Contact information

Having correct documents helps speed up the verification process.

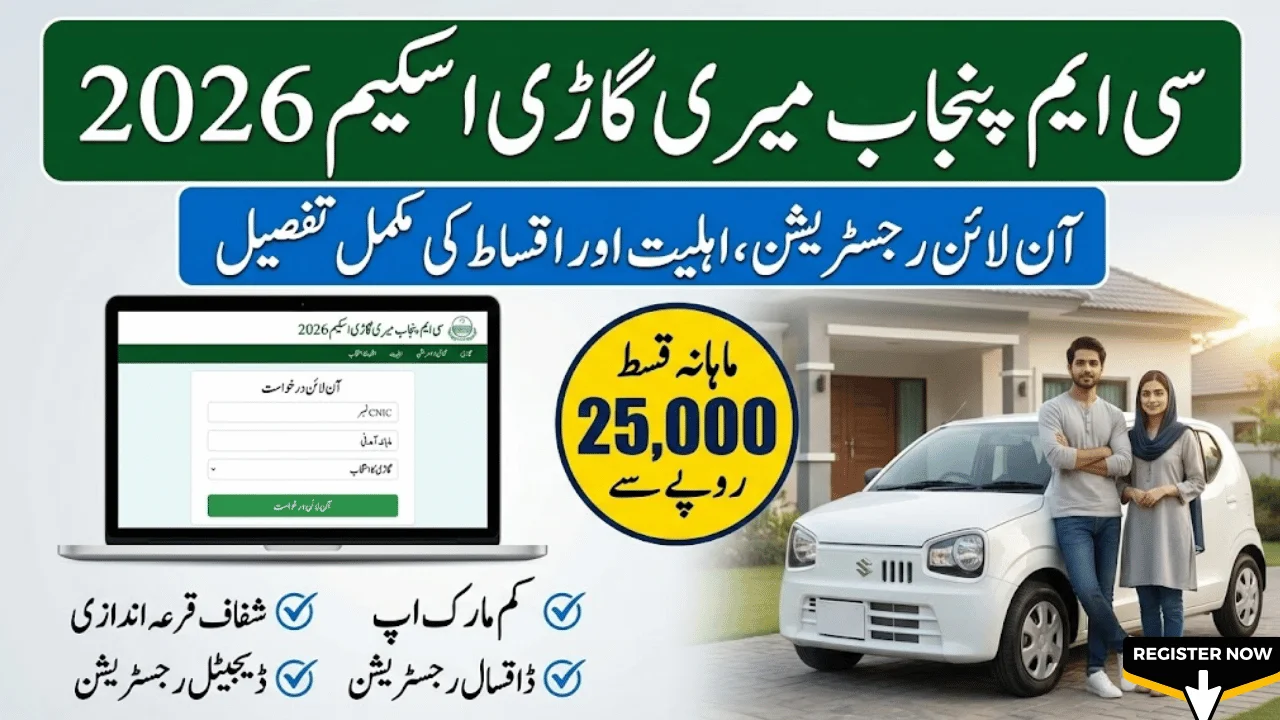

How to Apply Online for CM Punjab Loan Scheme 2026

The government has introduced a fully online registration system to ensure transparency and convenience:

-

Visit the official CM Punjab Loan Scheme portal

-

Click on Online Apply / Registration

-

Enter personal information (CNIC, name, contact)

-

Provide business or self-employment details

-

Upload required documents

-

Review the application carefully

-

Submit the form

After submission, a reference number is issued to track the application.

Loan Verification & Approval Process

Once the application is submitted:

-

Government officials verify the provided details

-

Documents and business information are checked

-

Eligible applicants receive approval notification

-

Loan amount is transferred to the applicant’s bank account

This process ensures fairness and prevents misuse.

Loan Repayment Terms

The CM Punjab Loan Scheme 2026 offers flexible repayment options:

-

Repayment period: 12 to 36 months

-

Monthly installments: Small and affordable

-

Interest rate: Lower than commercial banks

-

No hidden charges

These terms make repayment manageable even for small earners.

Benefits of CM Punjab Loan Scheme 2026

-

Easy access to business capital

-

Low-interest government support

-

Encourages self-employment

-

Reduces dependence on private lenders

-

Improves living standards

-

Boosts local economic activity

This scheme is a practical solution for people who want to work with dignity and independence.

Latest Government Programs on PVS.com.pk

Along with CM Punjab Loan Scheme updates, PVS.com.pk also provides information on:

-

CM Punjab programs

-

Prime Minister schemes

-

Parwaz Card 2026

-

BISP & social welfare updates

-

Latest news & trending topics

-

Gold prices & market updates

-

Technology & gadget news

All content is written in simple language with professional accuracy.

Conclusion

The CM Punjab Loan Scheme 2026 is a powerful step toward economic empowerment in Punjab. By offering easy loans with low interest and simple online registration, the government is enabling thousands of people to start businesses, earn independently, and build a better future.

For complete guides, latest updates, and authentic information about government schemes, keep visiting PVS.com.pk.

PVS.com.pk – Your Trusted Platform for Government Schemes & Public Information

This content is published for general information and awareness purposes. kixxoil.pk is an independent informational website and is not officially connected with any government authority or public institution. Readers are encouraged to confirm details directly from official sources before making any decisions.